In recent months, the once-declining GEO ecosystem appeared to be staging a comeback, fueled by the emergence of small GEO satellites—compact and cost-effective solutions that promised to revitalize the business case for GEO operators. But just as hope began to rise, headlines emerged revealing airlines—a long-standing customer base for GEO services—shifting to Starlink, while revenues from non-geostationary orbit (NGSO) communications continue to surge. If GEO operators want to maintain their market share and compete with LEO, they must compete with the lower ARPU’s driven by NGSO satellites1. Is the GEO resurgence merely a fleeting moment? What will it take to secure its future? In this post, we dive into the evolving GEO ecosystem, spotlight the major players, and uncover the critical gaps that must be addressed to ensure its long-term success.

Get a curated, easy-to-navigate database offering insights into the GEO ecosystem, including satellite builders, contracts, and component suppliers.

Today’s GEO ecosystem consists of satellites (both bus and payload), satellite sub-components, add-on mechanisms such as robotics and refueling systems, transportation services to orbit, and associated ground and ancillary services. While some of these areas have ample solutions, significant challenges remain in creating an affordable and thriving GEO ecosystem.

Target Customer

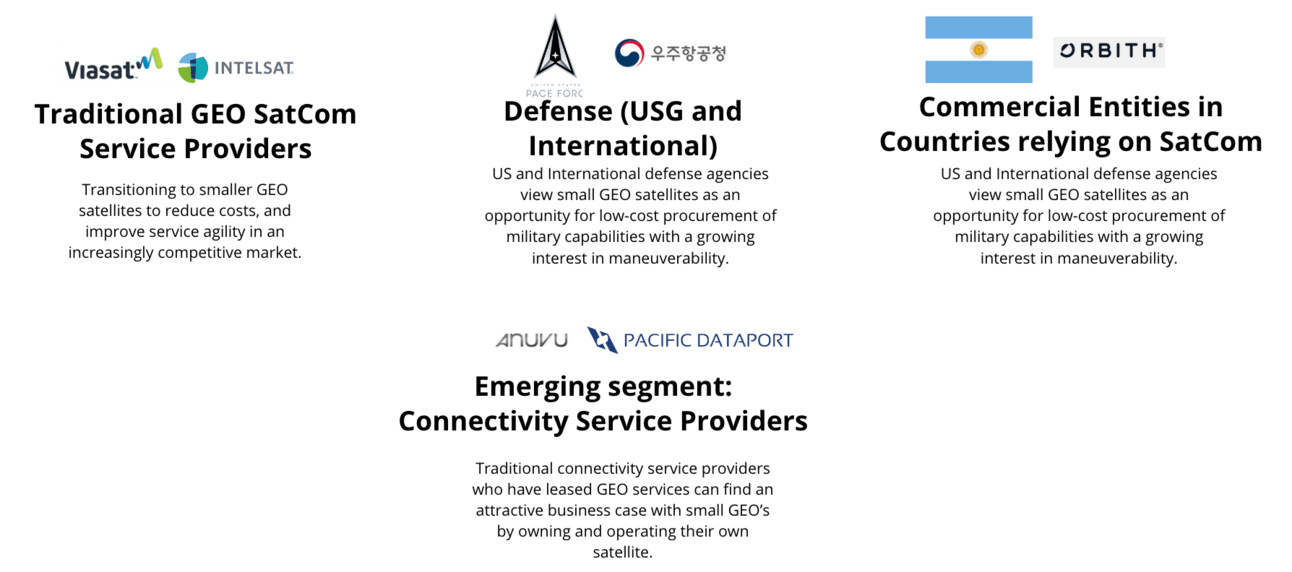

The target customers for small GEO satellites span both the commercial and defense sectors, each with distinct needs.

Traditional satellite communication operators typically focus on procuring satellite buses at the lowest cost, optimized for size, weight, and power to achieve attractive unit economics, as they often supply their own payloads. In contrast, international commercial entities frequently seek complete satellite solutions, including payload integration and, in many cases, end-to-end services such as launch. Meanwhile, U.S. defense customers present unique requirements, issuing solicitations for satellites with shorter operational lifetimes of 3–5 years, a sharp contrast to the nearly 15-year lifespan preferred by traditional commercial operators. These diverse requirements underline the importance of building flexible solutions to meet the varied priorities of these customer segments.

GEO Satellites

For years, the industry has been dominated by traditional GEO satellites, weighing between one and five tons, come with a price tag ranging from $100 million to $400 million and require three to five years to design and build. They are typically custom-built for specific missions, with specialized solutions to withstand the harsh conditions of space for 25 to 30 years2.

In contrast, smaller GEO satellites are more cost-effective (satellites builders claiming 1/10th the cost of traditional GEO), with lower production costs and significantly shorter lead times and lifetimes. A “small GEO” satellite ranges anywhere from 400 kg to 3000 kg depending on the spacecraft builder. Research by Analysys Mason forecasts roughly 1/3rd of the orders in the smaller GEO satellite range (<1000 kg) and 2/3rds on the larger end (>1000 kg).

These smaller satellites offer a more agile alternative, allowing for quicker deployment and reduced financial risk, making them an attractive option in the evolving space industry.

Source: Small GEO Satellite Growth," Analysys Mason, July 2024, accessed November 29, 2024, https://www.analysysmason.com/contentassets/221e1dbaba844e55a2e9d7e31b3096db/analysys_mason_small_geo_growth_jul2024_nsi041.pdf.

Key and Emerging Players

While the need for large GEO satellites persists, with traditional developers like Lockheed Martin, Boeing, and Airbus still active, much of the recent activity has been in the small GEO space. The landscape includes providers of satellite buses, payloads, and full-service solutions, highlighting the dynamic and competitive nature of this sector. Below are some of the key players with a further detailed list provided here.

Note: While some providers are only developing bus or payload, the industry tends to partner with each other to offer full solutions. Similarly, full satellite solution providers might be willing to sell individual components.

*Capacity as a Service - Astranis states they sell capacity as a service and also have full satellite solutions hence categorized in that bucket.

Key Challenges

Supply Chain

Unlike LEO, where "New Space" providers have successfully driven down costs for components by leveraging economies of scale and accepting higher risks in a less demanding radiation environment, the GEO market is significantly smaller.

Source: Sizing Up the 2023 GEO Manufacturing Battleground," SpaceNews, accessed November 29, 2024, https://spacenews.com/sizing-up-the-2023-geo-manufacturing-battleground/.

According to Novaspace (previously Euroconsult) there were roughly 15 GEO orders between 2000 and 2022 and looking forward, experts assume roughly 10 to 15 orders per year moving forward. The size of this market makes it hard for manufacturers to justify investment in the building blocks of these satellites.

Lack of payload availability

A key challenge facing the GEO market supply chain(which is dominated by Satcom) is the lack of availability of communications payloads due to the dichotomy between established and emerging players. On one hand, traditional aerospace giants like Lockheed Martin, Airbus, Thales and Boeing dominate the market with their proven expertise and extensive track record. However, their payload solutions often come with lengthy development timelines and prohibitively high costs, limiting accessibility for smaller operators and not closing the business case of small GEO satellites. On the other hand, newer entrants like Cesium are innovating with a more productized/COTS approach, yet they face skepticism due to their lack of GEO heritage. Unless solutions come in the form of a full satellite (Astranis, Space Network Services, etc. which are still fairly new) this creates a dilemma for GEO satellite operators, who must weigh the risks and benefits of established reliability versus the potential for cost savings and innovation offered by emerging players.

Expensive rad-hard components

Another barrier to GEO’s growth is the lack of affordable, radiation-hardened components. The stringent radiation requirements and smaller production volumes for GEO satellites make cost reduction difficult. This issue is further exacerbated by notable gaps in critical technologies like integrated propulsion systems and GNSS solutions tailored to GEO applications.

Sparse Launch

While cost-effective launch rate to LEO accelerates, affordable access to GEO orbits is a critical gap. There’s two primary ways today to get to GEO:

Option 1: Purchase a dedicated launch to Geostationary Transfer Orbit (GTO) or supersynchronous orbit. These orbits provide an efficient starting point for spacecraft to perform their own maneuvers, using onboard propulsion, to achieve their final geostationary position, which could take months with electric propulsion or shorter time with chemical propulsion. The current price of such an option is ~$70M on a Falcon 9 (based on website) and likely more expensive with Arianespace or other options. In the future, Starship, Vulcan and others may have more favorable options for even larger GEO satellites.

Option 2: Another way to reach GEO orbit is by utilizing an Orbital Transfer Vehicle (OTV) such as Impulse Space's Helios, Quantum Space's Ranger, Blue Ring, Exotrail or D-Orbit. While these technologies are still emerging and yet to be fully proven, they promise to offer a faster and more flexible route to GEO, with Impulse's Helios boasting the capability to transport payloads from LEO to GEO in just one day! These services are likely to be cheaper than the dedicated launch.

Conclusion

The GEO orbit is on the brink of transformation. While key attributes for a flourishing GEO ecosystem like small satellites with shorter-lifetime, and cost-effective sub-components have yet to fully emerge in the GEO realm, this presents a tremendous opportunity for innovation. The current launch landscape and limited availability of ‘COTS’ rad-hard products are challenges that the industry is actively addressing, with exciting advancements on the horizon. The small GEO renaissance is just beginning, driven by a wave of ambitious startups determined to disrupt traditional norms.

More Information

To download a list comparing the publicly available specifications of GEO spacecraft buses, component suppliers and recently publicly announced GEO spacecraft contracts and available payloads, click on the image below to purchase the data.